Here’s the truth: buyers now ask answer engines – ChatGPT, Perplexity, Gemini, Google’s AI Overviews/AI Mode – what to buy, who to trust, and which vendor to shortlist.

If you’re not mentioned (or misrepresented) in those answers, you’re invisible in zero-click journeys. That’s why “AI mentions” have become a pipeline metric, not just a PR vanity stat.

The kicker? Distribution is uneven. Early data shows AI Overviews lean toward high-authority sources; the top 50 domains grab ~30% of mentions, leaving everyone else to fight for the remaining share.

Meanwhile, marketing teams are racing to monitor sentiment, citations, and competitive coverage yet most providers don’t offer native analytics, forcing a new stack of dedicated trackers.

Translation: you need tools built for LLM visibility, not retrofitted SERP rank checkers.

Key Takeaways

- Pick tools by your reality: Google-heavy? Start with SE Ranking. Need broad coverage? Add Semrush. Want operator-grade AEO? RankPrompt. Enterprise governance? Profound. Lean and fast? Peec AI.

- Measure what matters: presence, citations, sentiment, competitive share, and (for Google) AI Overview trigger rate.

- Win with sources: LLMs favor high-authority/community content – target those pages and earn inclusion to compound visibility.

- Make it operational: Run a 30-day loop: baseline → source mapping → content/PR → re-scan → roadmap.

Top 5 Tools to Track AI Mentions (2026 Buyer’s List)

Below you’ll find the five platforms that actually surface where, how, and how often LLMs mention your brand plus what to do with the data. We’ll lead with the answer for each, then break down coverage, metrics, pricing ballparks, setup tips, and the “move” that turns visibility into revenue.

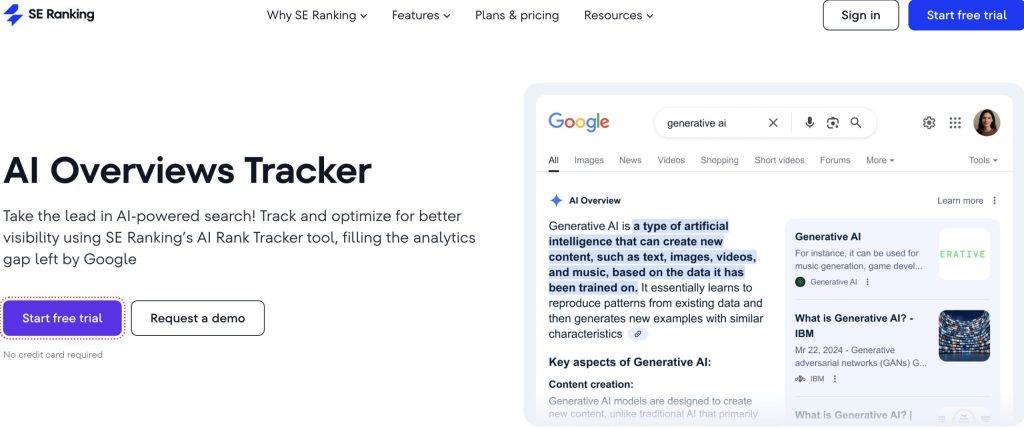

1. SE Ranking

If you need the most practical Google AI Overviews/AI Mode view side-by-side with classic rankings SE Ranking’s Generative AI/AI Overviews Tracker is the fastest win.

Expect quick rollout, clear diffs, and competitor context. But there’s more under the hood.

Why it works: SE Ranking’s AI Overviews Tracker shows when/where AI summaries appear and how your visibility compares to traditional results.

You get per-keyword diffs, appearance rates, and competitor coverage you can act on without rebuilding your stack. For orgs still living in “rank trackers,” this is the least-friction bridge into LLM reality.

The report includes an analysis of Google AI Overviews (also known as AI Mode) and how their presence has changed over time.

It provides a side-by-side comparison between classic search result positions and the visibility of AI-generated snippets. Additionally, it offers competitive and keyword-level diagnostics to help prioritize optimization efforts.

Standout metrics you’ll use

- % of tracked queries that trigger AI Overviews (by cluster)

- Brand/competitor presence inside AI Overview cards

- Movement deltas when AI Overviews contract/expand (important as Google keeps tuning rollout frequency). Recent industry studies show AI Overviews appear far less often than at launch so tracking when they show is half the game.

Pricing ballpark: Standard SE Ranking tiers with the AI module; exact pricing varies by plan/volume.

Who it’s for

- Teams tied to Google traffic who need fast AI Overviews telemetry without ripping out their SEO toolset

- Agencies supporting mixed SMB/enterprise portfolios

Setup tips (15–30 minutes)

- Import your top “money” keywords.

- Tag clusters: unbranded JTBD, category + “best”, competitor comparisons.

- Flip on AI Overviews tracking; export weekly changes for leadership.

Pro move: When AI Overviews cite high-authority third parties more than you, run a digital PR + entity reinforcement sprint to earn those citations.

If you need link velocity from credible sites, this guide to authoritative editorial backlinks will help prioritize the right publications, and this playbook to order backlinks (the safe way) explains how to do it without torching trust.

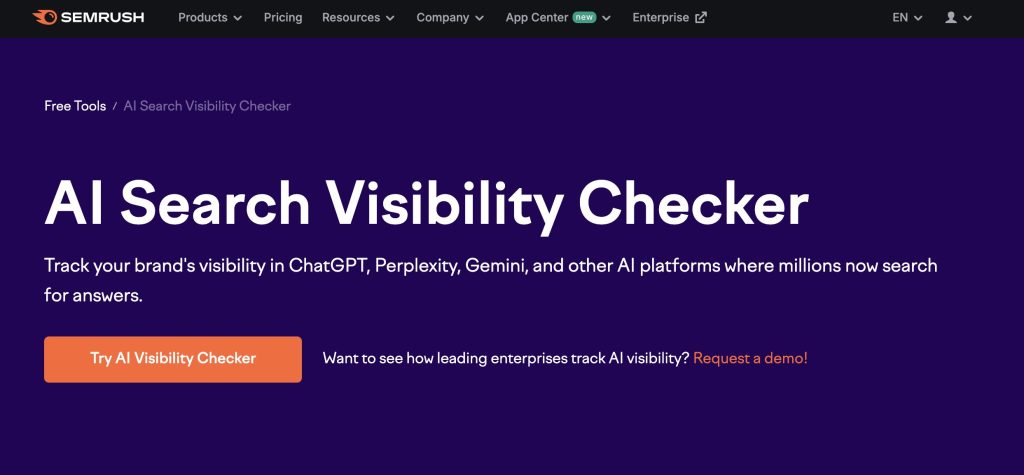

2. Semrush

Already in Semrush? Use the AI Search Visibility Checker to see how often ChatGPT, Perplexity, Gemini, and SearchGPT mention your brand plus the prompts where it happens.

It’s a tight diagnostic that plugs into Semrush’s broader AI SEO Toolkit.

Why it works: Semrush runs queries across top AI platforms and tracks brand mentions, products, and site references by prompt/theme.

That gives you a “share of mentions” baseline and a way to defend budgets with directional data even before a full enterprise rollout.

The analysis spans multiple platforms, including ChatGPT, SearchGPT, Perplexity, and Gemini. It features prompt and theme grouping to evaluate brand and category visibility across AI systems.

The data also integrates with broader Semrush AI SEO and visibility workflows, supporting studies on factors such as which sources AI platforms most frequently cite.

Standout metrics you’ll use

- Mention frequency by platform and prompt cluster

- Cited source mix (Semrush research shows LLMs often prefer community and high-authority sources in citations – useful for PR/content planning).

Pricing ballpark: Has a free checker; deeper features live in paid Semrush plans.

This is ideal for in-house teams already standardized on Semrush, as well as executives who want a concise, one-page cross-model snapshot that answers the question, “Are we visible?”

Setup tips (15 minutes)

- Enter your brand + competitor set.

- Add prompt clusters: “best [category],” “alternatives to [competitor],” “what is [problem],” “pricing for [product].”

- Export a monthly visibility delta for the board.

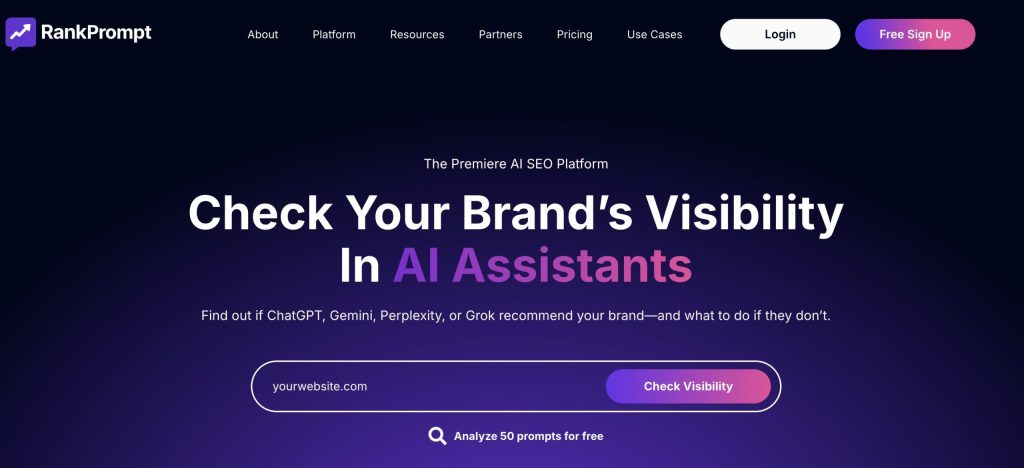

3. RankPrompt

If you want a platform designed for AI answer-engine optimization (AEO) with prompt-level diagnostics, competitor benchmarks, and prioritized to-dos, RankPrompt is the operator’s choice.

Why it works: RankPrompt scans large prompt sets across ChatGPT, Gemini, Perplexity, Grok, Copilot and flags where you appear, what’s said, and why a competitor is winning.

The kicker is the “do this next” layer: schema and citation suggestions tied to gaps.

Coverage highlights

- Multi-platform prompts, 150+ queries out-of-the-box for many categories

- Prompt-level inclusions/exclusions for you vs. competitors

- Schema and citation recommendations to improve odds of inclusion/linking

The report measures inclusion rates by prompt cluster and platform, showing how often your brand appears across different types of AI-generated responses.

It also analyzes competitive share within AI answers, comparing your brand’s presence to that of your top three rivals.

Finally, it identifies citation opportunities meaning pages that large language models already trust and reference but that don’t yet include your brand.

Pricing ballpark: Growth/Pro/Enterprise tiers; request demo for volume.

Who it’s for: This is designed for teams that want a single, unified view for both AEO and competitive strategies, as well as agencies managing LLM visibility retainers across multiple clients.

Setup tips (30–45 minutes)

- Load your market’s prompt templates (start with the platform’s preset list).

- Add your core entity signals (brand, products, alt names).

- Prioritize “near-wins” (prompts where you’re mentioned but not cited).

4. Profound

Need enterprise rigor, citations analysis, geo/language variance, governance workflows?

Profound is built for organizations that must audit what AI says, where it pulls sources, and how that varies by market.

Why it works: Profound tracks how often your brand appears, what AI says, and which sources drive answers then layers in platform-specific citation patterns and “source concentration” effects (i.e., a handful of powerful domains win disproportionate citations). For global brands, this is gold.

Coverage highlights

- Cross-platform AI answers with response analysis

- Citations and source mix by platform and topic

- Guidance geared to platform-specific preferences (what ChatGPT vs. Perplexity tends to cite)

The analysis examines source dependency by identifying how much of your brand’s visibility comes from a limited number of domains. It also explores geographic and language-based variations in both visibility and sentiment toward your brand.

Additionally, it includes governance tracking with a misstatements queue and defined remediation workflows to address inaccuracies in AI-generated content.

Pricing ballpark: Enterprise; book a demo.

Who it’s for

- Regulated industries and global enterprises

- Brands that must prove accuracy and reduce risk across markets

Setup tips (45–60 minutes)

- Upload controlled prompt sets by region/language.

- Label “must-be-accurate” claims for governance.

- Feed approved canonical sources so the team aligns PR/content to the right citations.

5. Peec AI

Want a focused, modern LLM visibility tool without enterprise overhead?

Peec AI tracks brand performance across ChatGPT, Perplexity, Claude, Gemini, and adds clean benchmarking and sentiment.

Why it works: Peec’s product clarity stands out: simple dashboards for appearance rate, competitor comparisons, and sentiment snapshots validated by visible endorsements from SEO leaders.

It’s a strong “less is more” choice when you need signal fast.

Standout metrics you’ll use

- Visibility trendlines per platform

- Sentiment deltas for key product claims

- Head-to-head vs. primary competitor

The report covers visibility across major AI platforms, including ChatGPT, Perplexity, Claude, and Gemini. It tracks brand and competitor visibility as well as sentiment toward each.

Additionally, it provides practical, easy-to-share reporting designed for stakeholders beyond the SEO team.

Pricing ballpark: SMB/scale-up friendly; details via site/demo.

Who it’s for: This is intended for growth teams and agile marketing organizations, as well as agencies seeking a lightweight LLM visibility add-on.

Setup tips (20–30 minutes)

- Track brand + 2 core competitors.

- Add JTBD prompts (how buyers actually ask).

- Pair with PR outreach to earn citations from sources LLMs already trust.

Comparison – Which Tool Fits You?

The table below compares leading tools designed to track and optimize brand or content visibility across AI-driven search and assistant platforms.

Each tool varies in focus from monitoring Google AI Overviews to analyzing multi-model mentions, prompt inclusion, or sentiment thus helping marketers choose the right solution based on their goals, coverage, and governance needs.

| Tool | Best For | Platforms Covered (examples) | Standout Metric |

| SE Ranking | Google AI Overviews + SERP diffing | Google AI Overviews/AI Mode | % queries triggering AIO + presence delta |

| Semrush | Cross-model share of mentions + free checks | ChatGPT, SearchGPT, Perplexity, Gemini | Share of mentions by prompt/theme |

| RankPrompt | Purpose-built AEO ops | ChatGPT, Gemini, Perplexity, Grok, Copilot | Prompt-level inclusion + prioritized fixes |

| Profound | Enterprise citations + geo strategy | Cross-platform | Source concentration & platform patterns |

| Peec AI | Lean visibility + sentiment | ChatGPT, Perplexity, Claude, Gemini | Visibility trends + sentiment |

How To Choose AI Mentions Tools

Scenario A – You live/die by Google traffic:

Pick SE Ranking for AIO tracking; add Semrush’s checker quarterly to sanity-check non-Google surfaces.

If you’re in a competitive review niche, run a digital PR snipe to the most-cited third-party pages that AIO references.

Scenario B – You need cross-model visibility and exec-ready reporting:

Go Semrush + RankPrompt.

Use Semrush for coverage breadth and “share of mentions,” then RankPrompt for prompt-level fixes and schema guidance.

Scenario C – You’re enterprise or regulated:

Adopt Profound for citation/GRC workflows, then layer Peec AI for lightweight team reporting.

Profound’s research on platform-specific citation patterns helps align PR and content to the sources models actually quote.

What to Track Exactly

Track presence, citations, sentiment, and competitor share across your buyers’ prompts. Then act on gaps with PR, content, and entity work.

The details and the money sit just beneath the surface.

Your minimum viable tracking set

- Presence rate: % of prompts where your brand appears (by platform)

- Citation count & source mix: how often you’re linked vs. unlinked; which domains power the answer

- Sentiment + summary accuracy: is your core value prop right/wrong?

- Competitive share of mentions: are rivals crowding you out?

- Trigger rate (Google only): % queries that even show AI Overviews this month (market reality check)

Mini-table: KPI definitions

| KPI | What it means | Why it matters |

| Presence Rate | Share of prompts where you’re included | Baseline exposure inside answer engines |

| Citation Velocity | Rate of new/recurring links in AI answers | Trust proxy; improves future inclusion |

| Source Concentration | % of mentions driven by top 10 domains | Over-reliance risk; guides PR targets |

| Sentiment Accuracy | Positive/neutral/negative + correctness | Protects brand and conversion rates |

| Competitive SOV | Your share vs. top competitors | Resource allocation; roadmap focus |

How To Turn Insights Into Wins

Play 1 – Close the citation gap

Identify the top cited domains on each platform, then pitch or partner to be featured on those pages by providing evidence-rich assets such as benchmarks, documentation, and case studies.

If building authority at scale is the goal, these guides on high-authority backlinks and strategic, white-hat acquisition methods will help accelerate the process.

- Identify top cited domains per platform.

- Pitch/partner to be included on those pages; ship evidence-rich assets (benchmarks, docs, case studies).

- If you need authority at scale, these guides to high-authority backlinks and smart, white-hat acquisition will shorten the runway.

Play 2 – Fix entity signals & summaries

Align your naming conventions, schema, and canonical pages, ensuring all product metadata is fully machine-readable.

Then, publish concise About, Comparison, and FAQ pages designed for direct inclusion and interpretation by LLMs.

- Align naming, schema, and canonical pages; ensure product metadata is machine-readable.

- Publish concise About/Comparison/FAQ pages that LLMs can lift directly.

Play 3 – Own buyer prompts

Map Jobs-to-Be-Done (JTBD) questions by persona and lifecycle stage, from awareness to consideration to decision. Develop evidence-dense content that includes clear methodology, quantitative data, and external validation.

Finally, use RankPrompt or Semrush to validate prompt-level inclusion and continuously iterate based on performance insights.

- Map JTBD questions by persona and lifecycle (awareness → consideration → decision).

- Create evidence-dense content (methodology, numbers, external validation).

- Use RankPrompt/Semrush to validate prompt-level inclusion and iterate.

Play 4 – Govern accuracy

In Profound, tag all “must-be-correct” claims and establish a monthly quality assurance process.

When correction channels are available, submit revisions supported by solid evidence; if not, focus on outranking inaccuracies in the trusted sources the platforms reference.

- In Profound, tag “must-be-correct” claims; set monthly QA.

- Where correction channels exist, submit with evidence; otherwise out-rank in sources the platforms trust.

Conclusion

Here’s the simple truth: AI mentions are the new distribution. If answer engines don’t name you – or cite you – you’re losing consideration before the click ever happens.

The fastest path forward is pragmatic: pick the tool that fits your reality, baseline visibility this month, then push authority and citations where the models already look.

Do that for one quarter and you’ll feel it in the pipeline, not just dashboards.

What to do now (in order):

- Choose your tool by scenario (Google-first, cross-model, or enterprise governance).

- Ship a 100–200 prompt set that mirrors how buyers actually ask.

- Track four KPIs weekly: presence, citations, sentiment, competitor share.

- Close gaps with targeted digital PR + entity plays – prioritize sources AI already trusts.

- Re-scan in 30 days; present delta and a 90-day roadmap to leadership.

For category-heavy brands like SaaS, ecommerce, or global enterprise operationalize this. Standardize prompts, build governance for misstatements, and align PR/content to the sources different models prefer.

FAQ – Track AI Mentions

What counts as an “AI mention”?

A reference to your brand inside AI answers (ChatGPT, Perplexity, Gemini, Google AI Overviews/AI Mode) – linked or unlinked, with sentiment.

Do citations matter more than mentions?

Yes, citations signal trust and can drive referral traffic. But unlinked mentions still influence buyer perception; track both.

How often do Google AI Overviews show up now?

Far less than launch – studies show single-digit to low-double-digit appearance rates in mid-2024 onward. Track trigger rate before over-investing.

Which sources do LLMs prefer to cite?

Research shows high-authority and community-edited sources (e.g., Wikipedia) often dominate citations across platforms. Align PR/content accordingly.

Can I do this manually?

Yes, run structured prompts monthly and log results. But at scale you’ll need purpose-built tools (Semrush, SE Ranking, RankPrompt, Profound, Peec).

How do I improve negative/incorrect summaries?

Publish evidence-backed pages, earn citations from trusted third parties, and use enterprise tools to track and govern.

What KPI will executives care about first?

Share of mentions by platform and its trend, backed by citation velocity on authority domains.

Does this replace classic SEO?

No, LLM visibility augments SEO. You still need crawlable, authoritative pages that answer buyer prompts (the same pages AI models pull from).