B2B SEO is not about ranking for every keyword. It’s about becoming the trusted answer to the buying questions real teams ask before they talk to sales.

Short, clear pages that solve risk and show proof will beat fluffy content every time.

Here’s the plan in plain English: map topics to the buyer journey, publish proof that removes doubt, and connect everything with clean structure and internal links.

Do this well and organic search turns into pipeline, not vanity traffic.

In this article…

Key Takeaways

- Proof beats volume: Build case study, integration, ROI/TCO, comparison, and security pages before scaling blog output.

- Entities > keywords: Standardize names, add schema, and link hubs → spokes so AI and search engines trust you.

- Technical first: Fix Core Web Vitals, crawl waste, and rendering issues so every page performs.

- Authority is earned: Publish research and co-market integrations to attract credible editorial citations.

- Measure like revenue: Monitor discovery, validation engagement, and influence pipeline.

What is B2B SEO

B2B SEO makes your company the default answer to high-stakes buying questions. It optimizes content, structure, and proof so entire committees can say “yes” with confidence.

Unlike B2C, you’re not chasing clicks. You’re building consensus across roles, risk concerns, and integration realities.

Think about how decisions actually happen. IT checks security and fit. Finance validates cost and ROI. Operations cares about implementation and change management.

Executives need strategic alignment. Each group searches in its own way, often at different times. Your job is to connect all those journeys into one trusted narrative.

That’s why B2B SEO favors depth over volume. You win with pages that answer hard questions fast, then link to detailed proof.

Integrations. Security. Comparisons. ROI and TCO. Implementation timelines. Real customer outcomes. These are the assets that move deals forward and attract credible links.

Cycles are longer and the stakes are higher. Buyers want self-serve clarity before they talk to sales. Search engines and AI summaries reward entities they can understand and verify.

Clear naming, structured data, and consistent relationships between your product, industries, and integrations help machines and humans trust you.

Measure differently, too. Top rankings without a qualified pipeline are a distraction.

Track discovery of strategic topics, engagement with validation pages, and assisted opportunities. Expect leading indicators within a few months, with revenue impact following as authority compounds.

Here are the core differences that shape your plan:

- Multiple decision makers, each with unique queries and objections.

- Proof-heavy content beats generic posts and listicles.

- Authority is earned through relevance, research, and partnerships.

For execution, anchor your site around a “consensus hub” per solution.

Above the fold, answer the big five: What does it integrate with? How secure is it? Why choose this over X? What results can customers expect? How fast is time-to-value? Then link to deeper pages with charts, checklists, and numbers.

Finally, treat link building as credibility engineering. In B2B, the most valuable citations come from industry publications, partners, and original research.

One well-designed benchmark or integration guide can outperform dozens of generic guest posts. Start narrow, stay relevant, and keep your methodology transparent.

Define success in terms leadership cares about. Rank and traffic matter but only as leading indicators. The scoreboard is pipeline created, win rate lift, and sales velocity.

That requires tracking that ties anonymous research to real accounts, plus touchpoint models that reflect how committees actually buy.

Build dashboards that highlight progress across discovery, validation, and conversion, so marketing, product, and sales see the same truth.

Above all, keep language plain. Name the product the same way everywhere. Use consistent labels for features, industries, and integrations. Add schema where it helps clarify meaning.

Use internal links to connect related topics so people and machines can navigate your thinking. When your story stays consistent across pages, docs, and third-party mentions, your authority compounds and your rankings turn into revenue.

That is the essence of B2B SEO: earn trust, remove risk, and guide consensus from search to signature. Do this consistently, and compounding authority does the heavy lifting.

Why B2B SEO Matters Now

B2B SEO matters because buyers research in self-serve mode, AI summaries filter visibility, and leadership wants revenue impact not vanity traffic.

Win here, and search becomes your most efficient pipeline engine. Miss it, and competitors shape the conversation before sales ever meets the account.

Across categories, buying groups are larger and more independent. Committees gather and reconcile findings without talking to sales, which raises the bar for clarity, proof, and consistency on your site.

At the same time, AI summaries compress click-through rates on generic results. The answer isn’t more content, it’s smarter content with stronger authority signals.

That means entity-clean pages, credible citations, and validation assets that de-risk decisions for IT, Finance, and Operations.

If you align content to those realities, you’ll see earlier coverage on high-intent queries, steadier assisted pipeline, and better win rates as proof pages do their job. If you don’t, even a healthy traffic chart won’t move revenue.

Use this moment to reframe your goals. Prioritize topical authority and validation depth over sheer volume.

Tighten product naming and schema so systems can understand and reference you correctly. Then earn belief, not just links: get cited by integration partners and industry publications, and let those mentions power both organic rankings and AI visibility.

When you need scale for link acquisition without risk, a white-hat authority approach keeps you credible in niche verticals.

For larger orgs with many stakeholders and properties, governance and measurement discipline matter; an enterprise-grade program structure helps you operationalize and report.

What changed in 2025: Larger buying groups rely on self-serve research; AI Overviews siphon clicks from generic results; SEO remains a leading top-of-funnel driver, but authority and citations now decide who gets surfaced.

| Metric to Watch | Why It Matters Now | What to Do Next |

| % of pages cited by trusted third parties | AI systems and engines favor sources with external validation. | Publish original benchmarks; co-market integrations; pitch industry outlets. |

| Engagement on validation assets (security, ROI, integrations) | Committees advance when objections are removed early. | Link these assets above the fold on product and solution pages. |

| Share of impressions in intent-rich queries (vs. generic) | High-intent terms convert despite lower CTRs on generic SERPs. | Build entity-clean pillars and role-specific clusters; prune fluff. |

How To Build a Solid Technical SEO Foundation

You win B2B SEO by making pages fast, crawlable, and unambiguous so humans and machines can trust what they see. Nail Core Web Vitals, fix crawl waste, and add clean structured data. Do this first, or your great content will underperform.

Technical work isn’t glamorous, but it prints compound returns. Faster pages boost conversion; clean architecture raises crawl efficiency; schema clarifies entities for modern SERPs and AI surfaces.

For B2B sites with many templates (product, docs, resources, blog, comparison, integrations), the goal is consistency: one way to load, name, and link everything.

If you’re a SaaS org with subdomains (app, docs, status), align standards and deploy the same monitoring stack across properties (Lighthouse CI + RUM + log analysis).

When you centralize this, editorial ships faster and every new page inherits performance by default.

For teams juggling multiple SKUs and regions, program-level governance beats one-off fixes especially if you’re scaling content velocity. A focused SaaS SEO program standardizes templates, schema, and internal linking for growth).

Non-negotiables to fix first:

Speed + stability (LCP, INP, CLS), crawlability (robots, canonicals, sitemaps), and clarity (structured data + consistent entity names). Get these green, then scale content with confidence.

Audit flow (do it in this order):

- Vitals baseline: Capture CWV from real users (field data) by template: product, docs, compare, blog.

- Render check: Ensure JS routes hydrate without hiding primary content from bots; test with URL Inspection.

- Crawl control: Fix robots, canonicals, hreflang, and consolidate parameters; update XML sitemaps daily.

- Thin/duplication: Deindex faceted junk; canonicalize near-dupes; merge orphaned posts into pillars.

- Internal links: Build hub → spoke paths (solutions → integrations → case studies) using descriptive anchors.

- Schema: Add JSON-LD for Organization, Product, FAQ/HowTo, and SoftwareApplication where relevant.

| Area | KPI / Rule | Target / Action |

| Core Web Vitals | LCP, INP, CLS at the 75th percentile | LCP ≤ 2.5s, INP < 200ms, CLS ≤ 0.1 (field data). |

| Crawl Efficiency | Prioritize valuable URLs; reduce waste | Keep sitemaps fresh; block faceted traps; only “large/rapidly-changing” sites need crawl-budget tuning. |

| Structured Data | Clear entity markup for eligibility | Use JSON-LD, follow Search Central guidelines; don’t block schema; validate with Rich Results Test. |

Tactically, fix render-blocking assets, third-party bloat, and long tasks first. Replace heavy bundles with code-splitting and defer non-essential scripts.

On crawl, collapse infinite parameter spaces and retire dead sections with 410s, not soft 404s. For schema, start with Organization + Product on every solution page, add FAQ where you answer specific objections, and wire SoftwareApplication on integration listings.

The result: faster discovery, cleaner summaries, and higher eligibility for rich results and AI surfaces so every proof page you publish works harder.

How To Do Keyword & Intent Research for B2B

Start with your ICP’s jobs-to-be-done, then classify queries by intent + stage and build clusters that answer objections (integration, security, ROI, comparisons).

Skip vanity volume. Prioritize high-intent patterns that signal buying motion and watch qualified pipelines rise. Now let’s make it concrete.

B2B keyword research isn’t guessing; it’s structured discovery. You’re mapping how committees search at different moments: early education, evaluation, and validation.

Treat keywords as questions with context: industry, role, stack, and risk. Verify intent directly in the SERP (what ranks, which formats), then assign each theme to a page type that can win.

As you cluster, keep names consistent so machines recognize your entities across pages, docs, and integrations. Finally, track outcomes beyond traffic: engagement on validation assets and assisted opportunities tied to those clusters.

Inputs that sharpen B2B intent (use all five): Existing customer language (sales calls, win/loss notes), competitor comparison pages, integration ecosystems, review sites’ pros/cons, and SERP features (People Also Ask, sitelinks) that reveal question shape.

Process:

- Mine seed topics from revenue data: Pull closed/won reasons, common integrations, and objections; turn them into seed terms and JTBD statements.

- Classify intent by stage: Label informational, commercial, and transactional modifiers and align to Awareness/Consideration/Validation. Verify in SERPs.

- Group by entities: Cluster around products, features, industries, and integrations; enforce consistent naming across pages and schema.

- Assign page types: Map each cluster to a page with the best chance to win (pillar, comparison, integration, ROI/TCO, case study).

- Prioritize by revenue signal: Score terms on proximity to purchase (e.g., “alternatives,” “pricing,” “integration with [X]”) over raw volume.

- Instrument and iterate: Ship pages, track validation-page engagement and assisted opps; prune or merge thin posts into pillars.

| Buyer Stage | Query Patterns That Convert | Best Page Type | Primary Success Metric |

| Awareness | “how to [improve metric] in [industry]”, “[problem] framework” | Pillar + explainer | Qualified organic entrances |

| Consideration | “[category] for [industry]”, “best [solution] for [role]” | Category hub + comparison | Demo/trial starts from hub |

| Validation | “[product] vs [competitor]”, “[product] pricing”, “integrates with [system]”, “[product] SOC 2” | Comparison, pricing, integration, security FAQ | Engagement on validation assets + assisted opps |

Once your clusters are live, reinforce them with credible mentions. In B2B, original benchmarks and integration guides attract the exact citations that help both rankings and AI visibility.

If you want to scale research-driven acquisition without risking reputation, adopt a white-hat authority approach tailored to B2B ecosystems.

How To Create High-Impact Content

Short answer: publish proof-heavy pages that remove risk for IT, Finance, and Operations then structure them so both humans and AI systems can extract answers instantly.

If your pages lead with the answer and back it with credible evidence, they’ll win attention and links even in compressed SERPs.

B2B content is different because buying groups are bigger, cycles are longer, and each stakeholder researches independently.

That changes the job of your content from “educate” to “enable consensus.” The fastest path is to build around pillars (jobs-to-be-done) with clusters that tackle objections (security, ROI, integrations, comparisons).

Keep naming consistent across pages, docs, and schema so entity signals stay clean and you’re easier to cite in AI Overviews.

Must-have assets that move deals: One standout case study, one integration guide, one ROI/TCO explainer, a candid competitor comparison, and a plain-English security/compliance FAQ. These five remove the biggest objections across the committee and create natural hooks for credible citations.

| Content Type | Buying Objection It Solves | Page Pattern (What to show above the fold) | Primary KPI |

| Case Study | “Will this work for a company like ours?” | 2–3 quantified outcomes + industry, stack, timeline | Influenced pipeline / win-rate lift |

| Integration Guide | “Does it fit our stack?” | List top systems + native/API + setup time | Partner-assisted opps / demo starts |

| ROI / TCO | “Is the payback real?” | Payback range + 3 cost drivers + calculator CTA | Pricing/ROI tool completions |

| Comparison | “Why you vs. X?” | 2–3 honest differentiators + 1 trade-off | Clicks to trial/demo from table |

| Security FAQ | “Is it safe/compliant?” | Certs (SOC 2/ISO) + data flow diagram | Security review requests |

Build these five first, then scale pillars and role-specific clusters around them. Keep answers short at the top, depth below, and proof everywhere.

That’s how you earn belief, citations, and the right traffic even as AI reshapes discovery.

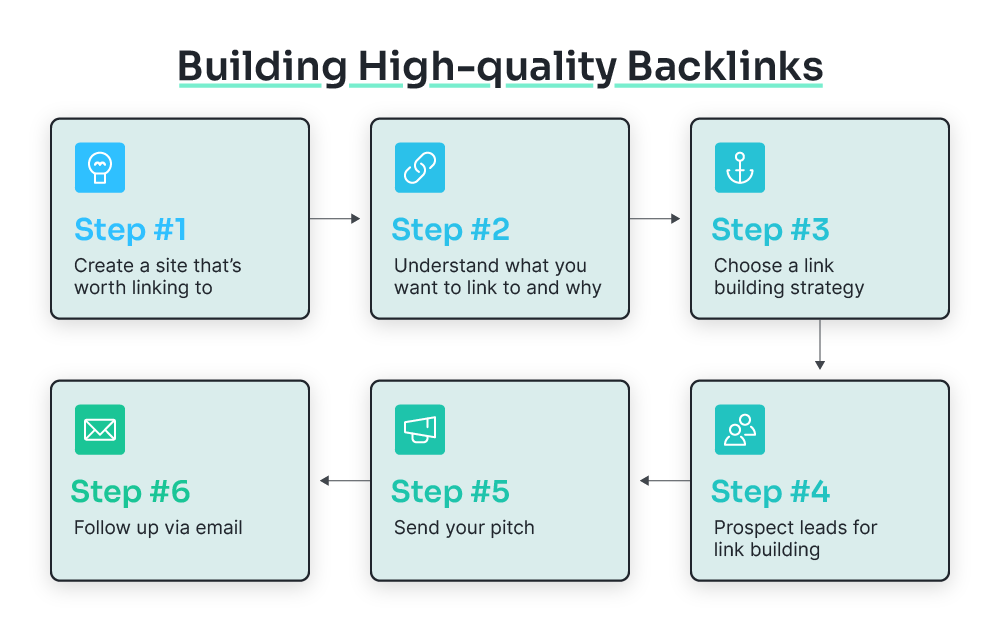

Do Link Building & Authority Right

In B2B, links must validate expertise not just pass PageRank. Earn editorial citations from industry sites, partners, and original research.

Avoid scaled schemes; Google neutralizes or treats them as spam. Want durable authority? Build it, don’t buy it.

B2B authority is about being the source others rely on. That means publishing assets people need to reference: benchmarks, integration docs, security explainers, and practical frameworks.

Keep anchors descriptive, ensure links are crawlable <a href> elements, and use the right attributes (rel=”sponsored”, nofollow, ugc”) when applicable.

The goal is credibility that survives algorithm updates and fuels both rankings and sales enablement.

What makes a good B2B backlink (quality checklist):

- Original benchmark: Publish annual “state of” data with transparent methods and downloadable CSVs.

- Integration launch: Co-author posts/docs with partners; cross-link product and implementation pages.

- Security & compliance hub: SOC 2/ISO explainer + data flows; pitch practitioner outlets.

- Pricing/TCO study: Share inputs and model assumptions; invite analysts to react.

- Comparison research: Honest differentiators + trade-offs; cite third-party criteria.

- Reclamation & decay: Fix 404s, update URLs, and re-pitch evergreen assets as facts change.

| Tactic | Who Links You | Pitch Angle | Primary KPI | Time-to-Impact |

| Original benchmark | Industry media, analysts, universities | “Exclusive data + charts” | Referring domains from industry sites | 4–10 weeks |

| Integration launch | Tech partners, marketplaces, docs | “Native setup + use cases” | Partner-assisted opps; RD from partner domains | 2–6 weeks |

| Security hub | Practitioner blogs, communities | “Plain-English SOC 2/ISO + diagrams” | Security review requests; RD from security sites | 3–8 weeks |

| Pricing/TCO | Finance/ops outlets, consultants | “Transparent inputs + calculator” | Tool completions; RD from finance ops blogs | 4–10 weeks |

| Comparison research | Review hubs, niche media | “Methodology + evidence” | Demo starts from comparison pages | 2–6 weeks |

| Reclamation & refresh | Sites already mentioning you | “Fix/point to current resource” | Restored links; fewer 404s | Ongoing |

Tactically, avoid footprints (templated guest posts, mass syndication, exact-match anchors).

Publish something worth citing, then ask for the citation. Partners, customers, and communities are receptive when the asset is genuinely helpful.

Finally, maintain your link graph: update outdated claims, redirect retired URLs, and keep data fresh so your best pages stay linkable year after year. Over time, many links die or change so proactive refresh preserves authority.

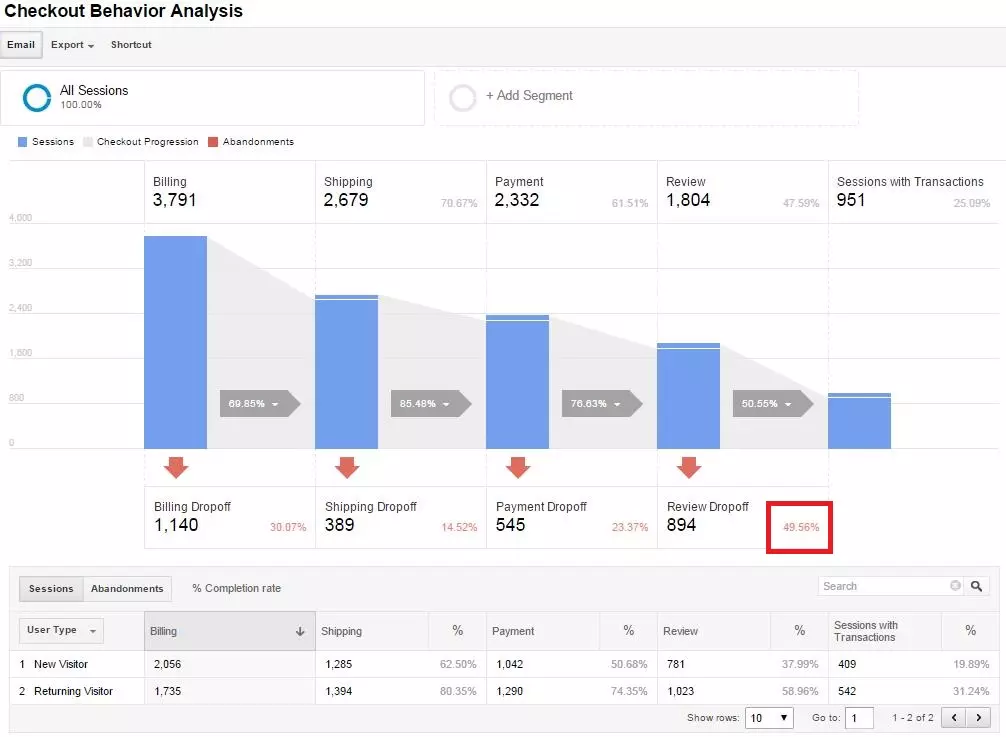

How To Measure / Optimize for Revenue

Treat SEO like a revenue program, not a traffic channel. Tie every cluster to a conversion path, attribute influence across the buying journey, and tune pages based on how they progress deals.

In B2B, multiple people research at different times and touch different assets. That means last-click reporting lies by omission.

You need a measurement stack that captures discovery (search), validation (proof assets), and conversion (demo/trial/security review) across sessions and stakeholders.

Do this, and you’ll spot which topics and pages pull buying committees forward and which ones are just pageviews with good intentions.

North-star metrics:

| Layer | What You Track | Why It Matters | Tooling & Notes |

| Discovery | Impressions, clicks, CTR, queries, pages | Proves you’re visible for the right intent and landing the first touch | Use the Search Console Performance report to trend by page/cluster. |

| Validation | Scroll/clicks on ROI, security, integrations; return visits | Shows committees are removing risk and aligning internally | Standardize events across templates; review weekly with sales. |

| Attribution | Assisted conversions, paths, model deltas | Gives fair credit to content that influences but doesn’t close | GA4 data-driven attribution; compare vs. last-click to show lift. |

| Buying Reality | # stakeholders, research touches, rep-free preference | Explains why multi-touch SEO measurement is non-negotiable | Typical buying groups include 6–10 stakeholders using multiple sources. |

A few calibration points. Search Console tells you what queries and pages drive discovery; use that to confirm you’re winning intent, not just volume.

GA4’s data-driven attribution shows how early-stage content assists later demos and security reviews; use model comparison to defend SEO’s contribution to pipeline.

Then optimize where it counts: raise the prominence of validation assets on pages that already rank, and tighten internal links from high-traffic explainers to decision pages.

When leadership sees impressions → validation actions → influenced pipeline in one clean view, the budget conversation gets easier and your roadmap gets the air cover it deserves.

How To Scale & Maintain Over Time

The goal is predictable publishing, refreshes that recover traffic, and governance that keeps templates, schema, and links consistent across properties. Here’s the model that scales without bloat.

Sustained growth needs two loops: a creation loop that ships new, intent-matched assets and a maintenance loop that prunes, consolidates, and refreshes to protect quality.

At scale, most gains come from reducing waste such as duplicate URLs, orphaned posts, and old content that dilutes topical authority.

Large or fast-changing sites should also watch crawl efficiency so important pages get recrawled quickly.

The table defines who owns what; the bullet list highlights levers that unlock scale; and the numbered cadence shows exactly how to run the machine week to week.

Scale levers (use these before you “add more content”):

Standardize page templates + schema across product, comparison, integration, ROI, and case study pages; centralize components (CTAs, FAQs) so refreshes propagate; set quarterly content pruning to update, merge, or remove decayed URLs that no longer serve users.

Operating cadence (run this every quarter):

- Inventory & score: Pull all URLs with traffic, links, conversions; flag decay and duplicates.

- Decide actions: Update, consolidate, redirect (410 for dead ends), or keep as-is with owners/dates.

- Governance pass: Enforce naming consistency, internal links from hubs → spokes, and schema.

- Crawl health: Review Crawl Stats, sitemaps, robots, canonicals; reduce parameter traps.

- Publish & re-submit: Ship refreshed pages; request re-indexing for major overhauls; monitor deltas 14/28 days.

Two final guardrails. First, keep sitemaps fresh and focus crawl demand on valuable URLs; most sites don’t need deep “crawl budget hacks,” just clean architecture and fewer junk pages.

Second, prune with intent: refresh strong candidates and consolidate the rest so authority flows to the content that should win. This reduces waste, speeds recrawls, and keeps your entity signals crisp as SERPs evolve.

Conclusion

B2B SEO works when your site removes risk, proves value, and makes it easy for buying committees to agree. You don’t need more pages, you need the right pages, built on a fast, clear foundation and reinforced by credible citations.

Keep answers short up top, depth below, and measure what leadership cares about: influenced opportunities and revenue.

If you run the operating cadence consistently: ship proof-heavy assets, maintain entity clarity, and refresh what decays so authority compounds.

That’s how rankings turn into demos, security reviews, and signed deals, even as AI reshapes discovery. The playbook is simple; the advantage comes from disciplined execution.

FAQ – B2B SEO

How long until B2B SEO impacts the pipeline?

Expect early leading indicators in 60–120 days; pipeline influence in months 4–9 for mid-market. Enterprise cycles take longer. Momentum compounds with authority and refreshes.

Do we need content for every stakeholder?

Yes, at least one asset per major objection: integrations, security, ROI/TCO, comparisons. Link them from product pages so each role finds proof fast.

What’s the minimum content to launch?

One strong case study, one integration guide, one ROI/TCO explainer, plus a clear product page. Add comparison and security FAQ next.

How many keywords should we target?

Fewer, deeper clusters. Prioritize intent-rich themes tied to buying jobs. Expand only when each cluster has a pillar, proof assets, and internal links.

Do blog posts still work?

Yes if they feed pillars and proof. Lead with answers, not fluff. Use posts to earn links and route traffic to validation pages.

Which link-building tactics actually move the needle?

Original research, integration launches, and credible industry placements. One relevant editorial link can beat dozens of generic mentions.

How should we measure success?

Track discovery (impressions/queries), validation (engagement on proof assets), and influence pipeline. Last-click alone undercounts SEO’s impact.

How will AI Overviews affect us?

They reward clear entities and credible citations. Standardize naming, add schema, and publish assets worth referencing (benchmarks, integration docs).