PR isn’t about vanity headlines. It’s an operating system for credibility that tilts high-stakes decisions – vendor shortlists, RFP invites, investor diligence – in your favor.

If you sell to skeptical buyers or regulated markets, you don’t “get” attention; you manufacture it with repeatable motions.

Here’s what most founders miss: the story isn’t your product; it’s your proof. Journalists want data, customers, and tension.

Buyers want clarity and risk reduction. Investors want public signals others believe. Package those three, and PR stops being a lottery and starts behaving like a growth loop.

In this article…

- What is Startup PR

- Why Startups Need PR Before They Need Funding

- How To Build a PR Strategy

- What Makes B2B & SaaS PR Different

- Why Fintech PR Has Extra Guardrails

- How eCommerce Startups Turn PR Into Revenue

- Do Press Releases Still Work for Startups?

- How To Pitch Journalists Without Sounding Desperate

- Why PR and SEO Compound

- How To Track PR ROI Without Fluff Metrics

- What a 90-Day PR Operating System Looks Like

- Conclusion

- FAQ – Startup PR Strategy

Key Takeaways

- PR = third-party credibility that shortens cycles, raises close rates, and compounds SEO – especially in B2B/SaaS, fintech, and eCommerce.

- Reporters prefer short, on-beat, proof-first pitches; average reply rates hover around ~3%. Keep it sub-200 words with real data.

- Fintech PR must align to MiCA/DORA/FCA; compliance-safe messaging wins coverage and avoids regulatory pain.

- eCommerce PR must connect to retail moments (Prime Day/BFCM) and conversion assets (badges, UGC, bundles).

- PR and SEO compound when you earn editorial links from relevant outlets and route attention into high-intent pages.

What is Startup PR

Startup PR is the discipline of engineering third-party proof that includes journalists, analysts, creators, partners, to change how your market judges risk. It isn’t “exposure.”

It’s evidence on demand. Lead with novelty and numbers, not adjectives, or every pitch reads like an ad. Ready to fix it?

Reporters are swamped and increasingly selective. Recent industry barometers show reply rates around 3–3.4%, with the best lift coming from short subjects (1–5 words) and sub-200-word pitches when they’re relevant and evidence-backed.

That means your system must favor angle quality and proof density over volume. Add one chart, one customer metric, and a single contrarian line, and your odds improve immediately.

PR vs. Marketing vs. Demand Gen (who “owns” what)

PR, Marketing, and Demand Gen each drive growth but through different means. PR builds third-party credibility with media, data stories, and analyst briefings, compounding quarterly to improve win rates and shorten diligence.

Marketing ensures message-market fit and buyer education through owned assets like the website, webinars, and case studies, typically influencing conversions over weeks to months.

Demand Gen focuses on immediate pipeline volume via paid campaigns, outbound, and events, producing results within days to weeks by filling the top and mid-funnel.

Together, they align credibility, education, and volume as complementary drivers of revenue.

| Function | Primary outcome | Assets it owns | Time horizon | Sales impact |

| PR | Third-party credibility | Data stories, press releases, media pitches, founder POV, analyst briefings | Compounds quarterly | Increases win rate; shortens diligence |

| Marketing | Message-market fit & education | Site, product pages, webinars, email nurture, case studies | Weeks–months | Improves conversion on owned channels |

| Demand Gen | Pipeline volume | Paid/ABM, outbound, events | Days–weeks | Fills the top/mid funnel |

7-day starter checklist:

- Write a tight “why now” (trend, regulation, partner ecosystem shift).

- Gather three proofs (one stat, one customer metric, one partner/analyst note).

- Build a 150–180-word pitch for a 20-reporter micro-list (on-beat).

- Prepare one clean chart with a 3-line method box (sample, timeframe, caveats).

- Offer access (exclusive/embargo + 15-minute founder slot).

Why Startups Need PR Before They Need Funding

Because buyers and investors form opinions before you ever meet them. Credible third-party signals pull you onto shortlists and into RFPs. Skip PR, and you’ll never see many of the best deals.

Gartner reports 61–75% of B2B buyers prefer a rep-free buying experience, meaning they self-educate first.

Meanwhile, “typical” buying groups include 6–10 stakeholders each consuming 4–5 sources they must reconcile.

Translation: public proof decides whether you’re even considered. Simultaneously, Edelman–LinkedIn’s study shows thought leadership is more trusted than marketing materials and increases RFP invites when it’s consistent and high-quality.

Stack signals like data reports, credible coverage, and analyst notes before the raise, so investors and buyers “discover” you on their own.

Signals that move decisions early:

- Tier-1/trade coverage with a data tile (chart + method)

- Proprietary research (survey or telemetry) that outlets can cite

- Analyst mention (briefings + customer receipts)

- Customer outcomes (quantified ROI, risk reduction)

Credible coverage signals category validation and momentum to buyers and VCs, while data reports give journalists and buyers proof of rigor and market insight.

Analyst notes reassure committees by showing fit within established evaluation frames, and case studies provide buyers with tangible outcomes that de-risk their purchase decision.

| Signal | Who checks it | What it proves |

| Credible coverage | Buyers, VCs | Category validation & momentum |

| Data report | Journalists, buyers | Rigor and market insight |

| Analyst note | Committees | Fit within evaluation frames |

| Case study | Buyers | Outcome; de-risked choice |

How To Build a PR Strategy

Outcome → Narrative → Proof → Channel → Cadence. Translate business goals into timely angles, attach evidence, pitch a tiny on-beat list, measure replies and coverage (not sends).

Want it to compound? Ship one story a week.

The operating system (weekly cadence):

| Block | What you produce | Why it works | Evidence to attach | Cadence |

| Outcome | 1-sentence commercial goal | Keeps PR accountable | KPI (pipeline, hiring, raise) | Quarterly reset |

| Narrative | Hook tied to a trend/reg | Relevance > features | “Why now” tension | Weekly |

| Proof | Data/case/analyst | Reporters prioritize data & visuals | Chart + method + quote | Weekly |

| Channel | 20-name micro-list | Personalization beats volume | Past coverage match | Weekly |

| Cadence | 150–180-word email | Higher responsiveness | Clear access offer | Weekly |

Benchmarks: average pitch responses sit near 3–3.4%; subjects 1–5 words respond best, and reporters overwhelmingly prefer sub-200 words. Test extremes, keep proof dense, and iterate weekly.

Numbered build (do this in 7 days):

- Choose one commercial outcome (e.g., “10 demos in fintech mid-market”).

- Draft a timely hook (e.g., DORA, PSD, consolidation) that affects your buyer.

- Add one chart + one customer metric + one quotable line.

- Assemble a 20-reporter micro-list from the last 60–90 days of on-beat stories.

- Send a 150–180-word pitch; one follow-up with a new detail – then stop.

What Makes B2B & SaaS PR Different

More cooks, longer cycles, higher stakes. Your proof must survive internal forwarding.

Build stories that reframe cost or risk for committees of 6–10 people who’ve each read 4–5 sources before a rep is looped in.

The B2B reality you must design for: Gartner notes buying groups typically include six to ten stakeholders, each bringing four to five pieces of outside information, and a majority of buyers report a rep-free preference.

That means your PR assets must travel well inside Slack threads and steering-committee docs: a crisp chart, a customer metric, a defensible method box, and a founder quote in plain English.

Package expert POVs (why this matters now), data (how big is the impact), and customer outcomes (what changed).

Persona-specific pitch pack

Journalists judge novelty, timeliness, and data, and are most influenced by a sharp chart paired with a founder quote that leads naturally to an interview or exclusive.

Analysts focus on fit and adoption, where a well-prepared briefing deck supported by two case studies positions the company strongly and earns a formal briefing.

Buyers weigh risk and ROI, and a case study combined with an ROI calculator and clear security posture reassures them enough to commit to a 30-minute demo.

| Persona | What they judge | Asset that wins | CTA |

| Journalist | Novelty, timeliness, data | 1 chart + founder quote | Interview / exclusive |

| Analyst | Fit & adoption | Briefing deck + 2 cases | Briefing |

| Buyer | Risk & ROI | Case study + ROI calc + security posture | 30-min demo |

Cadence for long cycles:

- Monthly: mini data cut (2–4 charts) tied to news

- Quarterly: 1 customer outcome + 1 analyst touch + 1 partner integration

- Anytime: react within hours to major platform/regulatory changes

Why Fintech PR Has Extra Guardrails

Because regulators read your press like examiners. MiCA (EU crypto), DORA (operational resilience), and FCA promotions rules (UK) shape what you can claim and how you disclose it.

Precision earns coverage; sloppiness triggers takedowns.

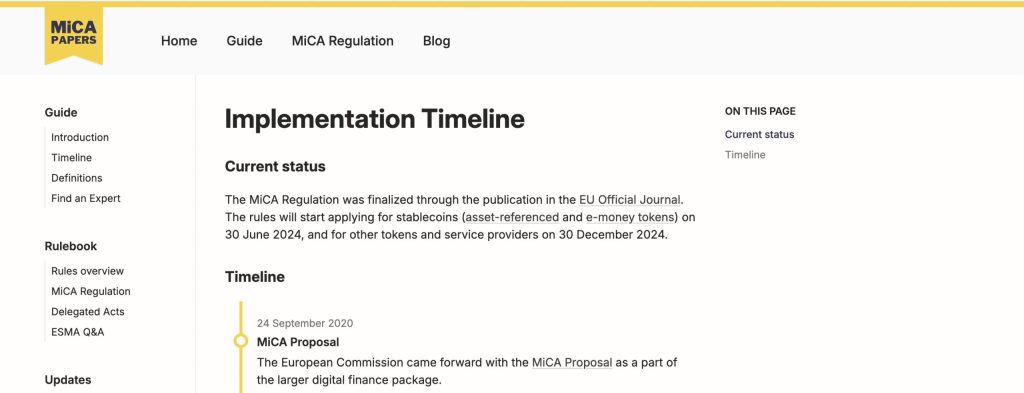

MiCA applies to stablecoins from June 30, 2024 and to most other tokens/service providers from Dec 30, 2024 – language must reflect actual authorization/registration and token type (e.g., EMT/ART).

DORA entered application on Jan 17, 2025; show incident readiness and third-party ICT oversight. Don’t hand-wave “bank-grade security.” Show schedules and SLAs.

FCA crypto promotions require mandated risk warnings and proper status lines for UK audiences. If you’re not registered/authorized, your claims and channels are restricted.

Safe rewrites founders can use

Founders often oversell regulatory status in ways that invite scrutiny. Instead of claiming to be “FCA-approved,” frame services as FCA-registered for AML with clear risk warnings.

Rather than calling a platform “DORA-compliant,” point to concrete practices like quarterly resilience tests and 24/7 incident response aligned with the regulation.

The pattern is simple: trade vague compliance labels for precise disclosures about status, scope, and safeguards. This not only keeps messaging regulator-safe but also strengthens credibility with buyers, analysts, and journalists who increasingly expect specificity over slogans.

| Risky claim | Safer, compliant pattern |

| “FCA-approved crypto app” | “Cryptoasset services provided by {Firm}, registered with the FCA for AML purposes; cryptoassets are high-risk.” |

| “DORA-compliant platform” | “Operates an ICT risk program with quarterly resilience tests and 24/7 incident response; aligned to DORA application Jan 17, 2025.” |

| “EU-approved stablecoin” | “EMT/ART status; operating under MiCA pathway; authorization/registration details and geographies available in our disclosures.” |

Green-light PR kit (pre-approved by legal):

- Claims registry: stat + sample + date + reviewer

- Status lines: “authorized/registered/partnered with …” per market

- Risk warnings: long/short versions by jurisdiction

- Methodology: how you calculated APY/latency/loss

- Incident comms: holding statements; first-hour workflow (DORA mindset)

How eCommerce Startups Turn PR Into Revenue

Tie every hit to a shoppable moment, a conversion asset, and measurable lift in your stores’ strategy. Badge the win, route to a matched landing page, and stack UGC. Use Prime Day/BFCM demand spikes to turn mentions into orders.

Consumers set records in Cyber Week 2024: Adobe confirmed $13.3B on Cyber Monday (U.S.), and Shopify merchants generated $11.5B in BFCM sales globally.

This July, Prime Day 2025 was projected near $24B across U.S. retailers. Slot a story into these windows and you convert attention into carts – if the page does its job.

PR moment → CRO mechanic

| PR moment | Destination | CRO asset | Why it converts |

| Prime Day feature | Prime Day hub | Time-boxed bundle + free ship | Urgency + value + message match |

| BFCM gift guide | BFCM collection | Tiered discounts + press badges | Social proof + deal framing |

| Expert review | Exact PDP | Long review highlights + Q&A | Detail lowers friction |

| Newsletter shout-out | Category page | UGC gallery + “as seen in” bar | Aggregated trust cues |

UGC is your conversion cheat code. Displaying reviews can increase conversion 190% for lower-priced items and up to 380% for higher-priced products; even a handful of reviews matters, especially early.

Put a 500-character review preview and photo UGC above the fold on PR landing pages and PDPs.

Do Press Releases Still Work for Startups?

Yes as a record of facts paired with a tailored pitch that tells the story. Releases with multimedia get significantly more visibility.

Keep it tight, data-led, and link to assets reporters can lift.

PR Newswire and Business Wire both state that press releases with multimedia see materially higher views/engagement (often 3×+).

Use the wire for discoverability, but win coverage with on-beat emails that bring an angle, a chart, and access.

When to ship a release vs. just pitch

Use press releases when you need a permanent, referenceable record such as funding rounds, major partnerships, executive hires, or data reports, while pairing them with tailored pitches that frame the story for specific journalists.

Feature launches often benefit from both: the wire helps discovery, but the real lift comes from a pitch that sharpens the angle. For smaller updates, skip the release and go straight to targeted outreach; flooding the wire with minor news dilutes credibility and wastes attention.

| Situation | Release? | Tailored pitch? | Why |

| Funding/major partnership/exec change | Yes | Yes | Record + narrative |

| Product/feature launch | Often | Yes | Wire aids discovery; pitch sells story |

| Data report | Yes | Yes | Reporters need facts and angle |

| Minor update | No | Yes | Don’t flood wires; target the beat |

Anatomy of a modern release (build like a data brief):

- Headline: what changed in the world

- Subhead: one stat + one outcome

- Lead: who/what/when/where/why + why now

- Data tile: chart + 3-line method

- Quotes: founder (specific), customer/partner (measurable)

- Multimedia: product screen or 20–30s clip (drives views)

How To Pitch Journalists Without Sounding Desperate

Relevance + proof + restraint. Keep it under ~200 words, lead with a timely tension, add one credible datapoint, and offer access (exclusive/embargo).

One thoughtful follow-up – then stop. Look like a source, not a spammer.

The no-desperation formula:

- Subject (1–5 words) with a specific outcome (e.g., “Cart declines −7%”).

- Lead: “Saw your piece on X. We analyzed N over T and found STAT.”

- Why now: tie to a regulation/platform shift or seasonal spike.

- Proof: one chart + method + customer metric.

- Access: 15-minute founder slot or an exclusive window.

Journalists overwhelmingly prefer sub-200-word pitches; Propel shows average response rates around 3–3.4% and best performance for 1–5-word subjects.

Why PR and SEO Compound

Editorial mentions = brand and links. If you turn data stories into authoritative backlinks, rankings and discovery climb – so does the pipeline.

Build digital PR that earns citations from relevant outlets and route traffic into intent pages.

Make every hit work twice:

- Convert data stories into editorial links that map to your category and commercial pages.

- Build newsroom hubs with schema/UTMs to concentrate authority.

- Avoid syndication traps (duplicate content); prioritize original coverage and niche trades.

How To Track PR ROI Without Fluff Metrics

Measure what the CFO cares about: assisted revenue, win-rate lift, and branded search growth – not just “hits.”

Build a single dashboard that tracks story quality, link equity, referral traffic, and pipeline influence.

The metrics stack:

- Pitch-level: replies, interviews scheduled, coverage rate, time-to-publish (manage to replies, not sends).

- Story-level: link quality/relevance (not just DA), referral sessions, average engaged time.

- Search lift: brand queries and non-brand rankings that move after high-authority links.

- Revenue-adjacent: assisted demos (B2B/SaaS), shortlist adds (fintech), first-time orders (eCom).

- Quality controls: % of pitches with chart + method + customer metric (target 100%).

Tie PR to revenue outcomes

| Motion | Metric that proves it | How to attribute |

| Data PR → links | Ranking uplift on target clusters | Pre/post cohort vs. control pages |

| Trade coverage → demos | Assisted opportunities with PR UTMs | Multi-touch model + “influence” tag |

| Gift-guide hit → orders | New-to-file orders & AOV lift | Last-click + assisted revenue split |

Bonus: If you target enterprises, connect PR to analyst briefings and RFP win rate to see late-stage impact.

What a 90-Day PR Operating System Looks Like

Ship one proof-led story a week. Layer monthly customer outcomes and quarterly tentpoles. Measure replies and revenue signals, not vanity metrics. This OS compounds fast.

90-day calendar (copy and adapt):

| Week | Core ship | Asset | Target |

| 1 | Data mini-report | 3–4 charts + method | Niche trades/newsletters |

| 2 | Case study | ROI/risk reduction metric | Industry trades |

| 3 | Founder POV | Timely, contrarian take | Opinion/analysis outlets |

| 4 | Partner integration | Co-PR, joint quote | Ecosystem press |

| 5 | Data mini-report | New cut of the dataset | Trades + podcasts |

| 6 | Customer panel | Video clip + transcript | Newsletters/YouTube |

| 7 | Founder POV | Regulation/platform impact | Policy/tech outlets |

| 8 | Case study | Outcome + deployment time | Vertical trades |

| 9 | Launch prep | Release + pitch list | Tier-1 + trades |

| 10 | Launch day | Release + exclusives | Tier-1 + newsletters |

| 11 | Analyst briefing | Briefing deck + 2 cases | AR firms |

| 12 | Round-up | “What changed” report | All owned channels |

Implementation notes:

- Keep a living reporter notes doc (beat, last story, angle they like).

- Build a press kit with headshots, logos, quotes, and raw charts.

- Run one exclusive per quarter to create a real news moment.

- For regulated fintech, pre-clear copy with legal and attach status lines.

Conclusion

If your market is complex or regulated, you win with proof, not adjectives. Build a weekly rhythm that converts trends into data-led pitches, earns editorial links, and feeds analyst briefings and demos.

Layer fintech guardrails or retail moments as appropriate and measure ROI like a CFO.

FAQ – Startup PR Strategy

How long should a pitch be?

Aim for 150–180 words with a specific subject. Most journalists prefer sub-200-word pitches when they’re relevant and complete.

How many reporters should I pitch?

Start with a 20-name micro-list of on-beat writers from the last 60–90 days. Relevance beats volume.

Do press releases help SEO?

They help discoverability and fact-checking. SEO lift comes mostly from editorial links earned by data-led stories – not from syndication.

What’s one thing to do this week?

Ship one chart with a 3-line method and a 150–180-word pitch tied to a live trend. Offer an exclusive.

What makes a fintech pitch credible?

Date your claims, state authorization/registration status, add risk warnings for the UK, and include a DORA-style controls summary.

What should a newsroom page include?

Latest releases, founder bio/headshots, downloadable logos, raw charts, and a methodology note for data.

How do I translate features into outcomes?

State the business delta (cost down, risk down, revenue up) in one line; attach a customer metric and security posture.

How do I prove eCommerce PR drives revenue?

Route traffic to matched landing pages with press badges and UGC. Track new-to-file orders, AOV, and refund rates from PR UTMs.